Understanding Credit Utilization

Credit utilization refers to the percentage of available credit that you're using across credit cards and additional lines of credit. This is determined by the balances shown in your credit report. Credit utilization plays a significant role in determining your credit score and can impact your ability to access credit in the future.

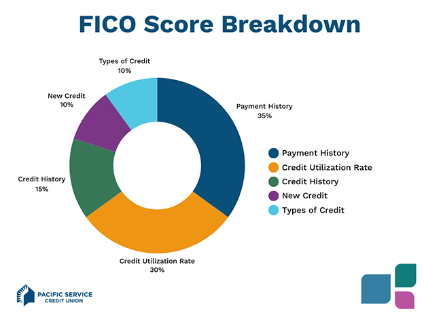

Credit utilization accounts for a significant portion of your credit score, specifically 30% of your FICO score. A high credit utilization ratio may indicate to lenders an excessive dependence on credit, potentially categorizing you as a higher-risk borrower. Keeping a low credit utilization ratio can have a positive impact on your credit score. This shows lenders that you can responsibly manage your credit and may increase your chances of being approved for loans or credit cards in the future.

To determine your credit utilization ratio, begin by summing up the credit limits across your revolving credit lines. Next, add up all your current balances owed on these revolving credit lines. Then, divide the total debt by the total credit limit, and then multiply this figure by 100 to calculate your credit utilization ratio.

For example, if you have a $6,500 balance on a credit card that has a $10,000 credit limit, your credit utilization ratio is 65%.

Lowering your credit utilization can lead towards improving your credit score. Here are a few ways to lower your utilization rates:

Understanding and managing your credit utilization ratio is a pivotal step in mastering your financial habits. It not only impacts your credit score but also reflects your financial discipline. By taking control of your credit, you can enhance your creditworthiness and open doors to better financial products and terms.

If you currently have high-rate credit cards or loans, call a member service representative at (888) 858-6878. We will help determine if we can save you money by refinancing high-cost loans.